Thank You for An Incredible Year

Christmas feels like the right time to share gratitude.

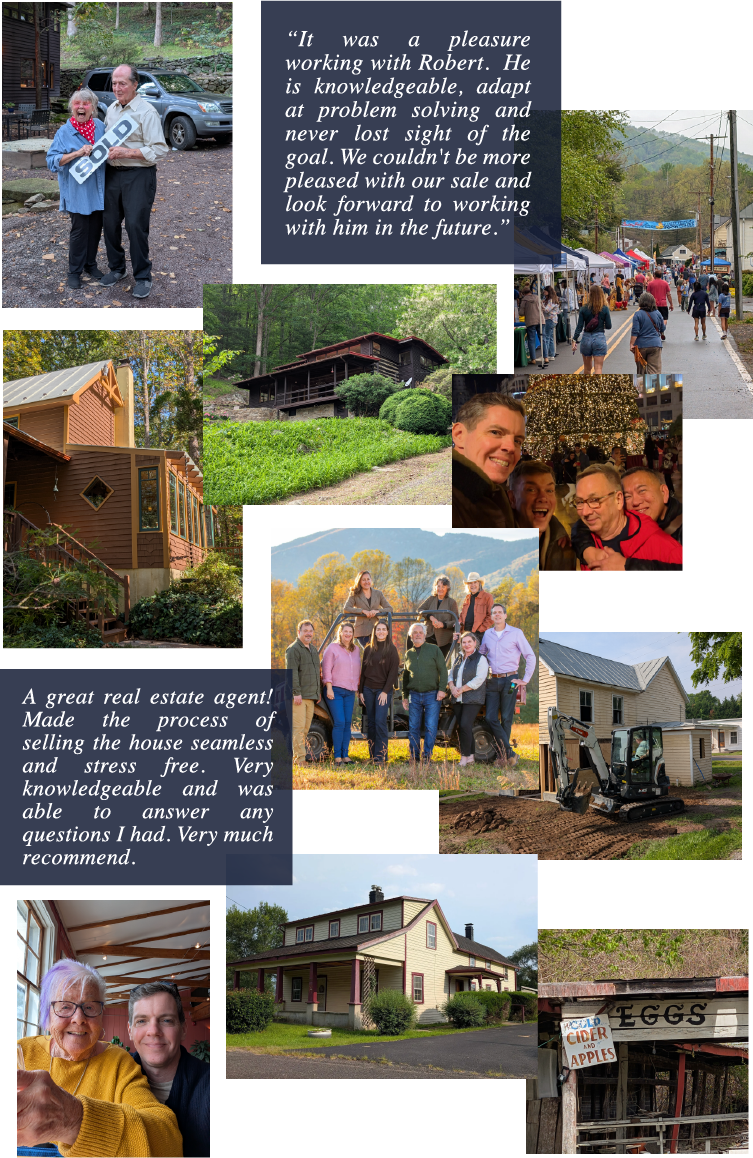

2025 marked my first year practicing residential real estate with the incredible team at Cheri Woodard Realty. Meeting new clients, doing business with old friends and seeing corners of our tremendously beautiful region are THE highlights of my year.

And man, what a year it’s been. I hit the ground running with my very first listing in Sperryville, built momentum through the year helping clients sell, buy - and even avoid - a myriad of properties. And now to close the year with yet another great listing under contract, this one in Amissville, feels like many accomplishments in such a short span.

So THANK YOU to the colleagues, clients and future clients reading this. 2026 feels like its going to be a big year (more on that below) and I’m here for it.

I hope you’ll continue to keep your eyes on your inbox for the (almost) weekly Saturday Showdown.

Happy Holidays and see you in 2026.

with thanks,

So What Will Real Estate

in 2026 Look Like?

(nerd out with me for a minute, I promise to keep it short)

There are a number of drivers that will impact or national and regional real estate markets, many of which are positive factors to improving inventory of available properties to choose from. More choices tend to be better for consumers.

Lower Rates = Stronger Buyers

We’ve all been watching the Fed signal additional rate cuts ahead. As rates decline, buyers typically gain greater purchasing power. Just as importantly, sellers feel more confident re-entering the market, which helps increase inventory.

6% Mortgages Are the New Normal

The number of mortgages at 6% and above is expected to surpass those below 3%, continuing to ease the “lock-in effect” that has kept many homeowners from moving. As we grow accustomed to rates in the 5.5%–6.5% range, mobility should improve.

Government Liquidity and Asset Prices

While increased government spending is not great for the strength of the Dollar (or your savings), the added liquidity tends to push asset prices — including both risk assets and real estate — higher, which can motivate sellers. Our economy today is largely driven by debt and liquidity cycles.

Rotating Leadership

Locally, a shift in Congressional control could reverse recent layoffs and closures in government agencies that have traditionally helped make our region relatively “recession-proof.” A hiring rebound would inject additional cash flow into the area and support property values.

All this points to 2026 being an interesting year. As always, I remain available to help clients align their personal real estate financial decisions with broader economic trends — whether buying or selling their next home or investment property.